cryptocurrency tax calculator reddit

Learn about Pennsylvania tax rates for income property sales tax and more to estimate your 2021 taxes. Indian government just announced that crypto will be taxed at 30 of gains.

Crypto Tax Calculator Overview Youtube

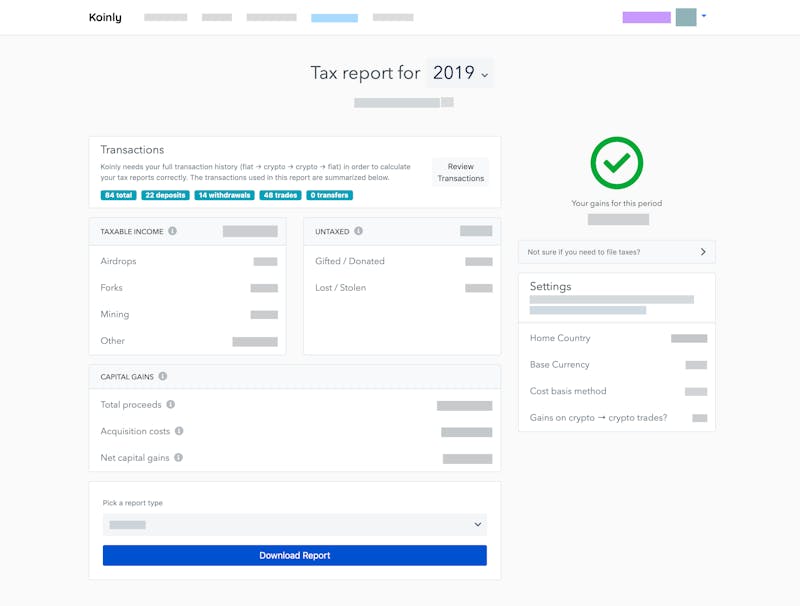

I mostly just use Koinly to find the market values at the time of my transactions and to have the value of my portfolio on my phone using the Android app.

. This is why cryptocurrency tax Shane explains is kind of a lagging market. If you sell both of them in the same financial year then this is how to calculate tax on cryptocurrency in India. For the purpose of estimating Janes CGT tax on her crypto asset alone we then apply this 325 tax rate to the 5000 capital gain included in Janes assessable income.

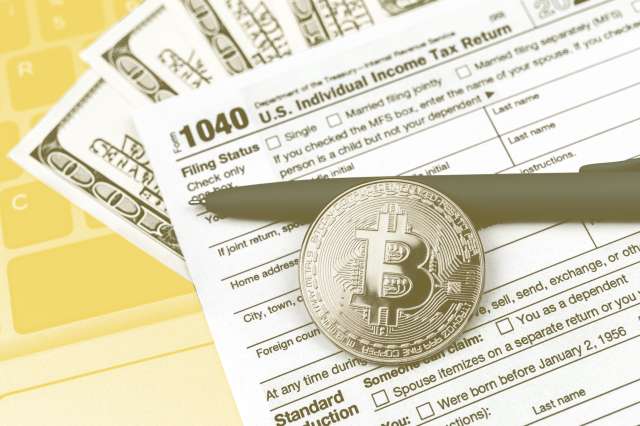

An online crypto tax manager. Bitcoin Taxes provides useful information about tax requirements in countries such as the US the UK Germany Australia Japan and Canada explains basic terms related to crypto taxation. Simple accurate and trusted.

Pennsylvania has a flat state income tax rate of 307. There are cloud-hosting tools specifically designed for crypto miners. Bitmex bybit and other crypto derivatives platforms has got tools to calculate the profit loss and to estimate the liquidation cost beforehand.

You would have to report a capital gain of 1000 50 of 2000 which would be added to your income and taxed at. This is the first time the Indian government is discussing crypto taxation. Take the initial investment amount lets assume it is 1000.

Zen Ledgers Bitcoin Crypto Tax Calculator. Business expenses will also not be allowed. You can discuss tax scenarios with your accountant.

We help you generate IRS compliant tax reports while maximizing your refund. Whatever method you use make sure you double check that everything is being calculated correctly. You simply import all your transaction history and export your report.

Crypto tax software reddit. Remember the net profit that you. Easily calculate your cryptocurrency taxes.

Blox supports the majority of the crypto coins and guides you through your taxation process. A lot will depend on your tax bracket if you earn less than 40000 in taxable income your capital gains tax is 0 there is also a collection of tax losses if you have a crypto you sold for a profit and another sold at a loss cancel these two and you will only be taxed on the different ones. Were still picking up a lot of customers who were trading in 20172018.

That presumably means tax year 2023 which is due in 2024 so all qualifying transactions occurring in 2023 must be reported. Detailed legal analysis from JDSupra Under the statute any person in a trade or business who receives more than 10000 in cash in a single transaction or in related transactions must file a Form 8300 within 15 days. Divide the initial investment amount with the amount of crypto purchased lets assume 1000 coins.

The brothers founded the. The business plan comes at 99 per month and covers 10K taxations and 20 million in assets. Learn about the state tax rates for income property sales tax and more to estimate your 2021 tax bill.

Your income bracket and how long you have held the cryptocurrency. In 2021 it ranges from 10-37 for short-term capital gains and 0-20 for long-term capital gains. Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports.

Cointrackers crypto portfolio calculator and crypto tax software has helped over 10000 users file their taxes on over 1 billion in crypto assets. How much tax you pay will depend on how long you hold your Bitcoin. The tax will apply to all gains on digital virtual assets and no capital losses will be allowed.

TokenTax is one of the most extensive tax calculation and reporting software out there for any crypto trader. For the amount of work Im doing I might as well do it all myself. Our subscription pricing is per year not tax year so with an annual subscription you can calculate your crypto taxes as far back as 2013.

The resulting number is your cost basis 10000 1000 10. Best Crypto tax reporting and calculation software. Janes estimated capital gains tax on her crypto asset sale is 1625.

Zenledger crypto tax supports over 400 exchanges including 30 defi protocols. In the US crypto-asset gains are calculated using two factors. This means you can get your books up to date yourself allowing you to save significant time and reduce the bill charged by your accountant.

We dont accept any new clients for 2021 tax season see you next year. Blox free Pro plan costs 50K AUM and covers 100 transactions. Heres an example of how to calculate the cost basis of your cryptocurrency.

IRS Added a Question on Crypto Usage to Income Tax Form. Northumberland Avenue on April 18 2018 in London England. Gates now fourth-richest person in the world with a net worth of 125.

1 lakh profit of Ethereum minus 50k loss of Bitcoin equals to 50k net profit on cryptos. I only have about 5000 in other savings. Microsoft cofounder Bill Gates isnt a fan of cryptocurrency.

0325 5000 1625. Personal use purchases with cryptocurrency less then a10000 are excluded from taxes. Koinly has got you covered.

The tax rate on this particular bracket is 325. Now you have to calculate 30 of this 50k net profit to pay cryptocurrency tax in India. Depending on your tax bracket for ordinary income tax purposes long-term capital gains which are recognized when an asset is held for at least one year one day are taxed at a rate of 0 15 or 20.

Whether you are a taxpayer looking to get an accurate crypto tax report a business looking to track your inventory or an accountant trying to work your way through a maze of transactions. In the US the cryptocurrency tax rate for federal taxes is the same as the capital gains tax rate. South Carolina income tax rates range from 0 to 7.

Mining software comparison gpu profitability ranking. We will also list some of the best crypto tax tools and software to help calculate your crypto earnings for the financial year trading on a cryptocurrency exchange in australia. The platform has made the entire process hassle-free by integrating with almost every crypto exchange out there.

The cryptocurrency tax calculator youll enjoy using.

Crypto Mining Taxes What You Need To Know

Bitcointaxer Org Open Source Crypto Tax Calculator And Portfolio Tracker R Cryptotax

Best Crypto Tax Software Top Solutions For 2022

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

A Capital Gains And Tax Calculator For Your Stock Crypto Investments R Personalfinancecanada

How To Calculate Crypto Taxes Koinly

A Capital Gains And Tax Calculator For Your Stock Crypto Investments R Personalfinancecanada

How To Calculate Crypto Taxes Koinly

Pin On Robotina Ico Ama Live Event

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Crypto Com S Free Tax Calculator R Cryptocurrency

Coinboard On Twitter Bitcoin Crypto Money Cryptocurrency

Cryptocurrency Taxes What To Know For 2021 Money

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

3 Steps To Calculate Binance Taxes 2022 Updated

3 Steps To Calculate Binance Taxes 2022 Updated

You Should Know That Crypto Com Have Their Own Free Crypto Tax Calculator R Cryptocurrency

22 Best Reddit Personal Finance Communities For Entrepreneurs And Business Owners Personal Finance Finance Finance Guide